Modele de facturi in XML acceptate in sistemul e-Factura pentru agentiile de turism

Cum se trece in XML e-Factura modalitatea de plata cu vouchere?

Intr-un document oficial, ANAF ne sugereaza cum ar trebui completat in sistemul e-Factura fisierul XML pentru agentiile de turism,care au obligatia de la 01 aprilie sa incarce in e-Factura toate facturile incasate cu vouchere de vacanta. Este vorba de documentul de la adresa:

https://static.anaf.ro/static/10/Anaf/Informatii_R/Comunicat_e-factura_aprilie2022_v2_050422.pdf

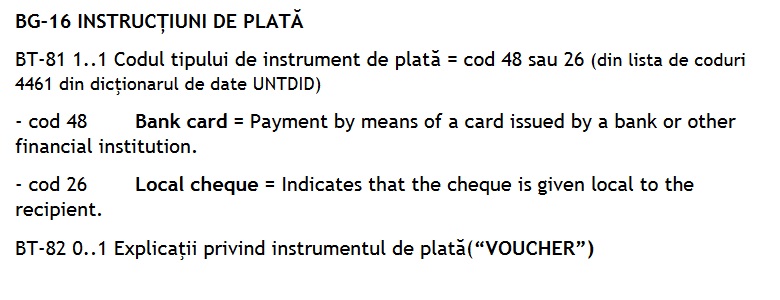

In acest document ni se spune cum vom completa in XML la modalitatile de plata pentru facturile incasate cu voucher si unde vom pune seria voucherului de vacanta:

Astfel, in XML se adauga tagul de PaymentMeans unde se selecteaza codul 26 si apoi se scriu seriile vocherelor.

Exemplu:

<cac:PaymentMeans>

<cbc:PaymentMeansCode>26</cbc:PaymentMeansCode>

<cbc:PaymentID>serie ticket vacanta: 123456789000</cbc:PaymentID>

</cac:PaymentMeans>

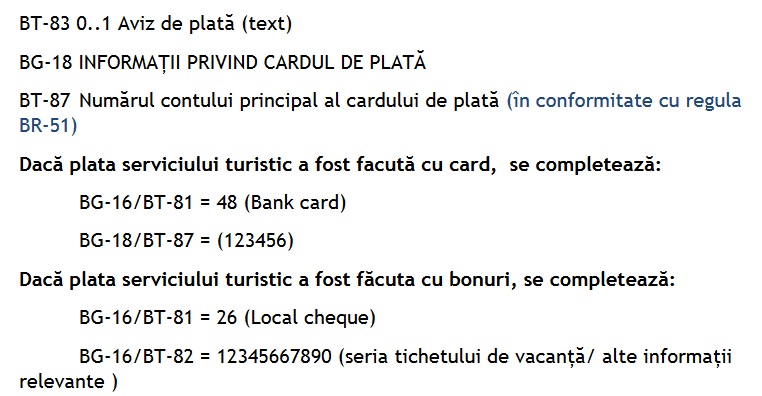

Cum se trece in XML e-Factura cota de tva de regimul marjei pentru agentiile de turism?

Intr-un alt document oficial, ANAF ne sugereaza cum sa completam in XML si cota de tva E- Scutit de tva si ne indica motivul scutirii pentru agentiile de turism pentru cota de tva regimul marjei:

Astfel, la cota de tva in XML se va completa cota E si motivul scutirii indicat: VATEX-EU-309

Exemplu de factura cu cota E-Scutit de tva pentru regimul marjei:

<?xml version="1.0" encoding="UTF-8"?>

<Invoice xmlns="urn:oasis:names:specification:ubl:schema:xsd:Invoice-2" xmlns:cac="urn:oasis:names:specification:ubl:schema:xsd:CommonAggregateComponents-2" xmlns:cbc="urn:oasis:names:specification:ubl:schema:xsd:CommonBasicComponents-2" xmlns:ccts="urn:un:unece:uncefact:documentation:2" xmlns:qdt="urn:oasis:names:specification:ubl:schema:xsd:QualifiedDataTypes-2" xmlns:udt="urn:oasis:names:specification:ubl:schema:xsd:UnqualifiedDataTypes-2" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xsi:schemaLocation="urn:oasis:names:specification:ubl:schema:xsd:Invoice-2 http://docs.oasis-open.org/ubl/os-UBL-2.1/xsd/maindoc/UBL-Invoice-2.1.xsd">

<cbc:CustomizationID>urn:cen.eu:en16931:2017#compliant#urn:efactura.mfinante.ro:CIUS-RO:1.0.0</cbc:CustomizationID>

<cbc:ID>FAC 3</cbc:ID>

<cbc:IssueDate>2022-06-16</cbc:IssueDate>

<cbc:DueDate>2022-06-30</cbc:DueDate>

<cbc:InvoiceTypeCode>380</cbc:InvoiceTypeCode>

<cbc:DocumentCurrencyCode>RON</cbc:DocumentCurrencyCode>

<cac:AccountingSupplierParty>

<cac:Party>

<cac:PartyIdentification>

<cbc:ID>34283300</cbc:ID>

</cac:PartyIdentification>

<cac:PartyName>

<cbc:Name>FACTURIS ONLINE SRL</cbc:Name>

</cac:PartyName>

<cac:PostalAddress>

<cbc:StreetName>B-DUL IULIU MANIU, NR.6E, PARTER, CAMERA NR 3, SC.1, AP.3, SECTOR 6</cbc:StreetName>

<cbc:CityName>SECTOR 6</cbc:CityName>

<cbc:CountrySubentity>RO-B</cbc:CountrySubentity>

<cac:Country>

<cbc:IdentificationCode>RO</cbc:IdentificationCode>

</cac:Country>

</cac:PostalAddress>

<cac:PartyTaxScheme>

<cbc:CompanyID>RO34283300</cbc:CompanyID>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:PartyTaxScheme>

<cac:PartyLegalEntity>

<cbc:RegistrationName>FACTURIS ONLINE SRL</cbc:RegistrationName>

<cbc:CompanyID>34283300</cbc:CompanyID>

</cac:PartyLegalEntity>

</cac:Party>

</cac:AccountingSupplierParty>

<cac:AccountingCustomerParty>

<cac:Party>

<cac:PartyIdentification>

<cbc:ID>19211548</cbc:ID>

</cac:PartyIdentification>

<cac:PartyName>

<cbc:Name>MIDSOFT IT GROUP SRL</cbc:Name>

</cac:PartyName>

<cac:PostalAddress>

<cbc:StreetName>B-DUL IULIU MANIU, NR.6E, PARTER,CAMERA 1, SC.1, AP.3, SECTOR 6</cbc:StreetName>

<cbc:CityName>SECTOR 6</cbc:CityName>

<cbc:CountrySubentity>RO-B</cbc:CountrySubentity>

<cac:Country>

<cbc:IdentificationCode>RO</cbc:IdentificationCode>

</cac:Country>

</cac:PostalAddress>

<cac:PartyTaxScheme>

<cbc:CompanyID>RO19211548</cbc:CompanyID>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:PartyTaxScheme>

<cac:PartyLegalEntity>

<cbc:RegistrationName>MIDSOFT IT GROUP SRL</cbc:RegistrationName>

<cbc:CompanyID>19211548</cbc:CompanyID>

</cac:PartyLegalEntity>

</cac:Party>

</cac:AccountingCustomerParty>

<cac:PaymentMeans>

<cbc:PaymentMeansCode>26</cbc:PaymentMeansCode>

<cbc:PaymentID>serie ticket vacanta: 123456789000</cbc:PaymentID>

</cac:PaymentMeans>

<cac:TaxTotal>

<cbc:TaxAmount currencyID="RON">0.00</cbc:TaxAmount>

<cac:TaxSubtotal>

<cbc:TaxableAmount currencyID="RON">2000.00</cbc:TaxableAmount>

<cbc:TaxAmount currencyID="RON">0.00</cbc:TaxAmount>

<cac:TaxCategory>

<cbc:ID>E</cbc:ID>

<cbc:TaxExemptionReasonCode>VATEX-EU-309</cbc:TaxExemptionReasonCode>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:TaxSubtotal>

</cac:TaxTotal>

<cac:LegalMonetaryTotal>

<cbc:LineExtensionAmount currencyID="RON">2000.00</cbc:LineExtensionAmount>

<cbc:TaxExclusiveAmount currencyID="RON">2000.00</cbc:TaxExclusiveAmount>

<cbc:TaxInclusiveAmount currencyID="RON">2000.00</cbc:TaxInclusiveAmount>

<cbc:PayableAmount currencyID="RON">2000.00</cbc:PayableAmount>

</cac:LegalMonetaryTotal>

<cac:InvoiceLine>

<cbc:ID>1</cbc:ID>

<cbc:InvoicedQuantity unitCode="H87">1.000</cbc:InvoicedQuantity>

<cbc:LineExtensionAmount currencyID="RON">2000.00</cbc:LineExtensionAmount>

<cac:Item>

<cbc:Name>bilet</cbc:Name>

<cac:ClassifiedTaxCategory>

<cbc:ID>E</cbc:ID>

<cbc:Percent>0.00</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:ClassifiedTaxCategory>

</cac:Item>

<cac:Price>

<cbc:PriceAmount currencyID="RON">2000.00</cbc:PriceAmount>

</cac:Price>

</cac:InvoiceLine>

</Invoice>

IUN.

2022