Modele de facturi in XML acceptate de sistemul e-Factura, pentru firmele neplatitoare de TVA

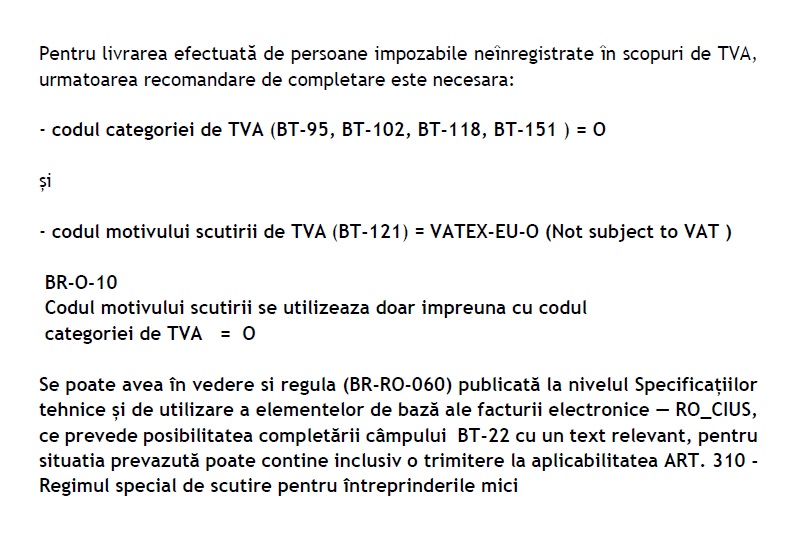

Intr-un document oficial de pe site-ul ANAF ni se sugereaza cum ar trebui completat acest XML pentru firmele neplatitoare de TVA:

In acest document se explica folosirea cotei O (fara taxe) si codul scutirii de tva care ar fi VATEX-EU-O.

Doar ca pentru aceasta cota de tva trebuie scos tagul de PartyTaxScheme si de la client si de la furnizor si de asemenea ar mai trebui scos si tagul 0.00 de peste tot de prin explicatia taxelor:

<cac:PartyTaxScheme>

<cbc:CompanyID>RO34283300</cbc:CompanyID>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:PartTaxScheme>

Exemplu de factura in XML (UBL 2.1) pentru o firma neplatitoare de TVA:

<?xml version="1.0" encoding="UTF-8"?>

<Invoice xmlns="urn:oasis:names:specification:ubl:schema:xsd:Invoice-2" xmlns:cac="urn:oasis:names:specification:ubl:schema:xsd:CommonAggregateComponents-2" xmlns:cbc="urn:oasis:names:specification:ubl:schema:xsd:CommonBasicComponents-2" xmlns:ccts="urn:un:unece:uncefact:documentation:2" xmlns:qdt="urn:oasis:names:specification:ubl:schema:xsd:QualifiedDataTypes-2" xmlns:udt="urn:oasis:names:specification:ubl:schema:xsd:UnqualifiedDataTypes-2" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xsi:schemaLocation="urn:oasis:names:specification:ubl:schema:xsd:Invoice-2 http://docs.oasis-open.org/ubl/os-UBL-2.1/xsd/maindoc/UBL-Invoice-2.1.xsd">

<cbc:CustomizationID>urn:cen.eu:en16931:2017#compliant#urn:efactura.mfinante.ro:CIUS-RO:1.0.0</cbc:CustomizationID>

<cbc:ID>FAC 1</cbc:ID>

<cbc:IssueDate>2022-06-14</cbc:IssueDate>

<cbc:DueDate>2022-06-28</cbc:DueDate>

<cbc:InvoiceTypeCode>380</cbc:InvoiceTypeCode>

<cbc:DocumentCurrencyCode>RON</cbc:DocumentCurrencyCode>

<cac:AccountingSupplierParty>

<cac:Party>

<cac:PartyIdentification>

<cbc:ID>34283300</cbc:ID>

</cac:PartyIdentification>

<cac:PartyName>

<cbc:Name>FACTURIS ONLINE SRL</cbc:Name>

</cac:PartyName>

<cac:PostalAddress>

<cbc:StreetName>B-DUL IULIU MANIU, NR.6E, PARTER, CAMERA NR 3, SC.1, AP.3, SECTOR 6</cbc:StreetName>

<cbc:CityName>SECTOR6</cbc:CityName>

<cbc:CountrySubentity>RO-B</cbc:CountrySubentity>

<cac:Country>

<cbc:IdentificationCode>RO</cbc:IdentificationCode>

</cac:Country>

</cac:PostalAddress>

<cac:PartyLegalEntity>

<cbc:RegistrationName>FACTURIS ONLINE SRL</cbc:RegistrationName>

<cbc:CompanyID>34283300</cbc:CompanyID>

</cac:PartyLegalEntity>

</cac:Party>

</cac:AccountingSupplierParty>

<cac:AccountingCustomerParty>

<cac:Party>

<cac:PartyIdentification>

<cbc:ID>19211548</cbc:ID>

</cac:PartyIdentification>

<cac:PartyName>

<cbc:Name>MIDSOFT IT GROUP SRL</cbc:Name>

</cac:PartyName>

<cac:PostalAddress>

<cbc:StreetName>B-DUL IULIU MANIU, NR.6E, PARTER,CAMERA 1, SC.1, AP.3, SECTOR 6</cbc:StreetName>

<cbc:CityName>SECTOR6</cbc:CityName>

<cbc:CountrySubentity>RO-B</cbc:CountrySubentity>

<cac:Country>

<cbc:IdentificationCode>RO</cbc:IdentificationCode>

</cac:Country>

</cac:PostalAddress>

<cac:PartyLegalEntity>

<cbc:RegistrationName>MIDSOFT IT GROUP SRL</cbc:RegistrationName>

<cbc:CompanyID>19211548</cbc:CompanyID>

</cac:PartyLegalEntity>

</cac:Party>

</cac:AccountingCustomerParty>

<cac:TaxTotal>

<cbc:TaxAmount currencyID="RON">0.00</cbc:TaxAmount>

<cac:TaxSubtotal>

<cbc:TaxableAmount currencyID="RON">5000.00</cbc:TaxableAmount>

<cbc:TaxAmount currencyID="RON">0.00</cbc:TaxAmount>

<cac:TaxCategory>

<cbc:ID>O</cbc:ID>

<cbc:TaxExemptionReasonCode>VATEX-EU-O</cbc:TaxExemptionReasonCode>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:TaxSubtotal>

</cac:TaxTotal>

<cac:LegalMonetaryTotal>

<cbc:LineExtensionAmount currencyID="RON">5000.00</cbc:LineExtensionAmount>

<cbc:TaxExclusiveAmount currencyID="RON">5000.00</cbc:TaxExclusiveAmount>

<cbc:TaxInclusiveAmount currencyID="RON">5000.00</cbc:TaxInclusiveAmount>

<cbc:PayableAmount currencyID="RON">5000.00</cbc:PayableAmount>

</cac:LegalMonetaryTotal>

<cac:InvoiceLine>

<cbc:ID>1</cbc:ID>

<cbc:InvoicedQuantity unitCode="H87">5.000</cbc:InvoicedQuantity>

<cbc:LineExtensionAmount currencyID="RON">5000.00</cbc:LineExtensionAmount>

<cac:Item>

<cbc:Name>Test e-factura</cbc:Name>

<cac:ClassifiedTaxCategory>

<cbc:ID>O</cbc:ID>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:ClassifiedTaxCategory>

</cac:Item>

<cac:Price>

<cbc:PriceAmount currencyID="RON">1000.00</cbc:PriceAmount>

</cac:Price>

</cac:InvoiceLine>

</Invoice>

IUN.

2022